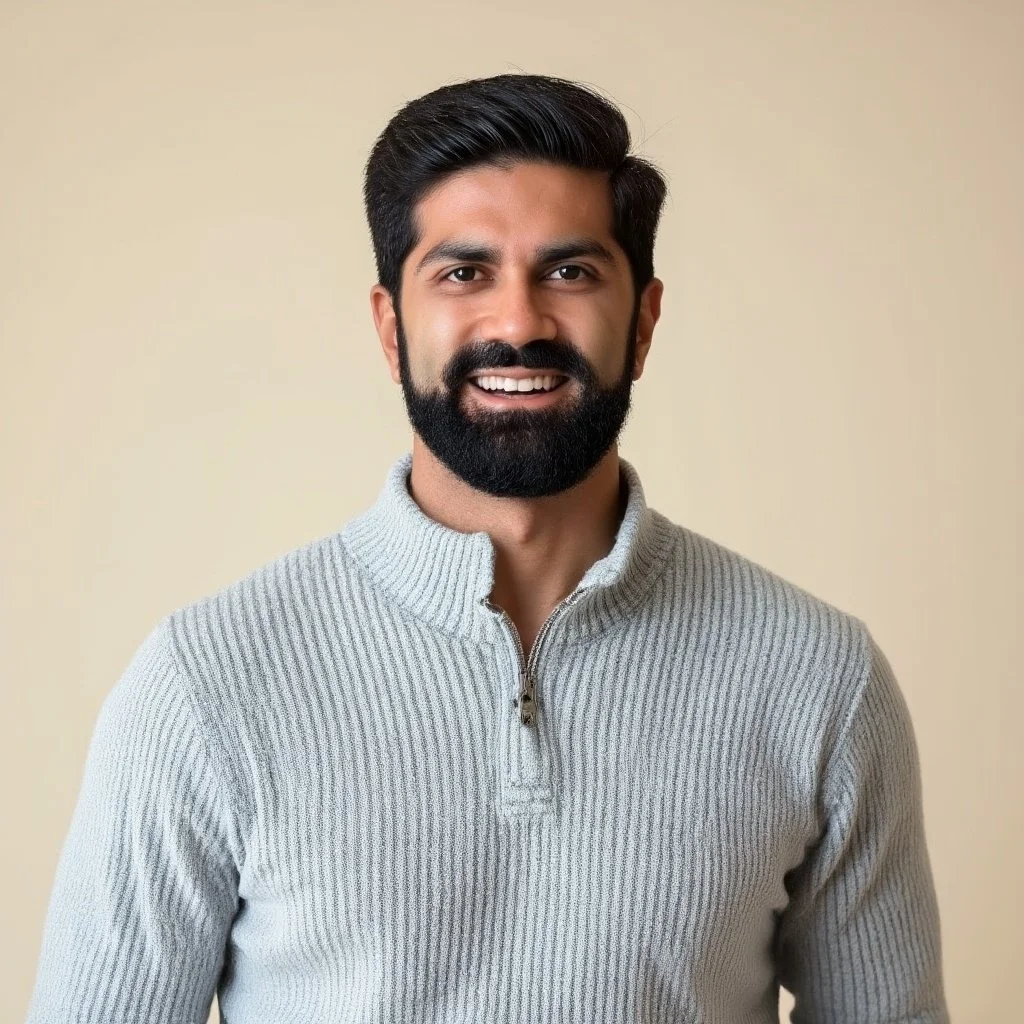

Sushen Talwar

CPA, FMVA

Web3 Finance Leader

About

Hello - I'm Sushen, but in the world of web3, I also go by 'soosh'.

A web3 finance leader with a specialization in scaling finance & operational infrastructure from 0 to 1 for companies, through leveraging my crypto accounting, traditional accounting, audit (both external & internal), technical & revenue accounting experience.

Extensive experience with software implementations, working with vague/non-existent guidance, automating monthly close tasks, applying GAAP and FASB principles for complex accounting transactions, building finance and operational teams, working cross-functionally for goals and OKRs, while working directly with founders to make their vision come to reality!

I write quick snippet blog posts that cover crypto topics for people who are not crypto-native. You can read these posts on this website as the series labelled as 'Scratching the surface with Soosh'. You can read these posts on the home page on this website!

Personal life includes lots of traveling (target of 2-3 countries a year), playing basketball & volleyball, photography (a photographer of over a decade), working out at the gym, and spending time with my adorable corgi-husky mix dog, Luna!

Traveling has been a part of my life since 2017. So far I have visited 25 countries spread over 5 continents. I plan to see all 7 continents and all natural & man-made wonders of the world.

My Experience

-

DECEMBER 2024 - PRESENT

As a member of the Leadership team, worked on executing the company strategy and the new blockchain launch while working very closely across all teams at Syndicate Labs on weekly OKRs.

Managed cash and treasury operations totaling $15M USD and $70M+ in $SYND Token, optimizing working capital, ensuring operational liquidity and designing risk management framework for both cash and digital asset holdings

Researched & executed organizational restructuring under the DUNA (Decentralized Unincorporated Nonprofit Association) framework while emanating all legal matters with counsel: the Operations, Token regulatory compliance and US Securities Law.

Transitioned all accounting and budgeting operations in-house from third party services providers and established financial reporting systems internally delivering monthly and quarterly reports to the founders & leadership team.

Developed financial models and forecasts supporting strategic planning, fundraising efforts, and led OTC deals for $SYND.

Worked on the Tokenomics design and Token Allocation strategy, in addition to leading all investors relations initiatives with $SYND token distribution associated agreements (TPA, RTA, Warrants etc.).

Built scalable operational infrastructure and frameworks across departments and leadership teams, while building and leading a two-person finance and operations team with performance metrics and professional development programs.

Negotiated and managed all vendor & service provider relationships to reduce operational costs while improving service quality. Managed cap table on Pulley for quarterly equity budgets for new hires, refreshers, performance grants, and bonuses.

Led all investor reporting and board reporting for financials operations, token operations and strategic initiatives.

Website - https://syndicate.io/

-

FEBRUARY 2022 - PRESENT

Bringing like-minded folks in one place is something I have been very passionate about. When I transitioned into web3 full time at a finance capacity, I did not have many peers to lean on with technical or complex accounting/finance/tax questions.

I started a free web3 finance community: Web3HODL, which started as a small community and has now grown into a community of 300 finance, treasury, accounting and tax professionals representing protocols, Layer 1, Layer 2, Marketplaces, DeFi, Infrastructure projects and many more.

Link to the Slack Community here: https://join.slack.com/t/web3hodl/shared_invite/zt-1471zohdu-TRGYSogLo3ZDTZVfRAtybA

-

JANUARY 2023 - PRESENT

Working closely with the founders and their engineer + product team with new features to ensure GAAP compliance.

Website - https://integral.xyz/

-

MAY 2025 - PRESENT

The goal of SoDA is to translate onchain holdings into clear & articulate reporting for all stakeholders reviewing a Balance Sheet.

Website - https://www.sodafinance.xyz/

-

FEBRUARY 2023 - NOVEMBER 2024

First in-house & first finance leader at Zora, scaling all accounting, investment, FP&A, tax, and treasury from 0 to 1.

Managed bank risk within the first few weeks transitioning away from Silvergate, SVB and Signature while ensuring 100% of cash in these accounts was recovered prior to the withdrawal window ended and onboarding to three new banks.

Managed US GAAP compliant global accounting using QuickBooks, Remote.com, JustWorks, Brex, Airbase and Carta.

Managed Crypto accounting using Integral tool (~600K txn/month) for both Zora Labs and Zora Network (L2 blockchain).

Introduced Crypto Treasury practice and managed ~$35M in aggregate in Coinbase Prime, Gemini Custody & Multisigs across 6 supported blockchains. Additionally, also introduced traditional treasury practice and managed T-bills with Fidelity.

Implemented monthly and quarterly departmental budgets through the tool Runway, which improved transparency in the department spend for department heads and provided thorough breakdown for each expense within the tool.

Managed and owned Investor Relations: ranging from monthly, quarterly, and annual investor financial updates, dashboards, queries, investor audits and fund audits.

Transitioned accounting from third party to inhouse by bringing in a Senior Accountant, which led to over 3 folds in closing time; month close was shrunk from 2.5 weeks to 5 business days within two quarters, to 4 business days in three quarters.

Actively monitored crypto markets to take advantage of tax advantage swaps by leveraging prior NOLs thus decreasing capital tax exposure to near 0% for 2023 fiscal year and first half of 2024 fiscal year.

Developed reports and crypto modules to early adapt FASB regulation while staying compliant with US GAAP and IRS guidelines for fiscal 2022, 2023 and 2024 years.

Worked closely with in-house GC and outside legal firms to ensure regulatory compliance + SEC compliance for all new product features, flow of funds and for blockchain network operations to ensure MTL, KYC and AML were satisfied.

Implemented a wallet management infrastructure to manage company’s 150+ wallets, multisigs and custody accounts, while working with head of security to ensure access and exposure to crypto risk was minimized at all controllable points.

Worked cross functionally with Product, Partnership, GTM and Legal on new product features, branding and compliance while working with Operations to ensure all employee, compensation and equity related work at the organization.

Managed extremely confidential reports and simulations that were used to determine a company-wide RIF (reduce-in-workforce) within included performance, 360-feedback, and cost vs benefit of each headcount across the organization.

Managed external relationships for taxes, 409A valuation with Attivo, Armanino, Altum, Deloitte Tax and Carta.

Actively managed the Labs’ cap table while introducing Quarterly equity budgets to ensure new hire grants, refreshers, performance grants and bonuses were accounted for while maintaining accuracy of the cap table.

Evaluated potential targets, created financial models, performed valuations & deal structures for potential M&A targets.

Actively monitored working capital, including monthly liquid cash and crypto balances, and rebalanced proactively to avoid business interruptions to meet business and company obligations.

Designed and implemented internal controls for all cash and crypto related touch points in addition to approval processes for bills, vendors, budgets, credit card spend, office spend, operational expenses, and grants.

Website - https://zora.co/

Mint.Fun Acquisition - https://zora.co/writings/zora-has-acquired-mint-fun

Zora Launches L2 - https://decrypt.co/145650/zora-launches-layer-2-nft-netowrk-battle-ethereum-gas-fees -

JUNE 2022 - MARCH 2024

Automate your token distributions with compliance. Manage token vesting, lockups, airdrops, and global payroll with built-in compliance.

Liquifi was acquired by Coinbase in July 2025

Website - June 2022 - March 2024

Automate your token distributions with compliance. Manage token vesting, lockups, airdrops, and global payroll with built-in compliance.

Liquifi was acquired by Coinbase in July 2025

-

FEBRUARY 2023 - DECEMBER 2023

First Finance Consultant for the RARE Protocol (SuperRare DAO). Help set up an infrastructure for compliance and financial reporting for all DAO Revenue and DAO Expenses including workflows for MSA payments and direct crypto-payments to vendors, advisors and consultants without relying on SuperRare Labs as a service provider/middleman for payments.

Total DAO Treasury at peak that was managed was ~$140M inclusive of $RARE, $USDC, $WETH and $ETH.

SuperRare DAO: https://docs.superrare.com/whitepapers/master/the-superrare-dao

-

FEBRUARY 2022 - FEBRUARY 2023

First non-executive finance hire introduced and implemented all bookkeeping infrastructure & month close procedures.

Managed the Crypto accounting for Labs and SuperRare DAO using Cryptio, Ledgible and Integral, including the Foundation’s native token $RARE.

Managed the traditional accounting books using QuickBooks, JustWorks, Bill.com, Airbase and Carta.

Introduced Treasury diversification for Labs (~$6M) - adjusted on a quarterly basis for all Crypto assets.

Led the distribution process for all $RARE Token distributions to investors, advisors and employees using LiquiFi.

Worked cross functionally with Business Development, Partnerships and Events teams on events, corporate partnerships, and long-term growth plans for B2B deals and brand deals.

Assisted the leadership team with financial planning regarding departmental budgets and project budgets.

Established & documented policies while maintaining effective accounting controls to improve monthly close.

Implemented internal controls and safeguards over company assets/crypto assets, payments of authorized expenses and ensured Labs was aligned with compliance for any committed contractual obligations.

SuperRare DAO: https://docs.superrare.com/whitepapers/master/the-superrare-dao

Gucci Investment: https://www.coindesk.com/business/2022/06/23/gucci-invests-25k-in-nft-marketplace-superrare-to-start-digital-art-vault

-

NOVEMBER 2020 - FEBRUARY 2022

Rated in the Top 15% of the employees during mid-year & annual performance reviews (~300 employees).

Led the Due Diligence for Cash, Revenue & AR related items for the Series D fundraise ($960M post money, $110M Cash).

Partnered with Sales Ops & Product team to identify workflow inefficiencies and implemented process.

Worked cross functionally to develop system flows for the OTC process to manage ~$50M ARR.

Executed monthly and quarterly revenue close procedures in accordance with US GAAP. Developed & maintained Heap’s revenue recognition policies and procedures under ASC 606.

Worked with the CRO, VP Partnership & VP Sales on LATAM expansion plan and new products offerings.

Supported deal negotiations and provided input on contract structure to align with business objectives.

Supervised the Accounts Receivable Analyst & Senior Revenue Accountant and reviewed all work performed by staff.

Automated working papers to streamline processes & initiated companies' Standard Operating Procedures (SOP).

Led cross-functional teams in the successful delivery of software projects, adhering to strict timelines and budget constraints.

Conducted stakeholder meetings to gather requirements, prioritize tasks, and communicate project progress effectively.

Series D Funding: https://www.heap.io/blog/series-d-funding-the-future-of-digital-analytics

Acquisition: https://contentsquare.com/blog/contentsquare-completes-acquisition-heap/

-

JULY 2019 - NOVEMBER 2020

Performed audits in compliance with IFRS and Bill 198 (Canadian SOX); traded on TSX.

Led the Internal Audit for 33 Canadian and US entities; responsible for 40% of the Global Rev (~$5.3B CAD).

Reported directly to CEO, CFO, VP Operations, Audit Committee and Board of Directors.

Developed professional relationship with the GMs and Controllers of North American operations.

Implemented IFRS 15 & 16, alongside CFO/Controllers and updated the Company's Financial Policies.

-

OCTOBER 2017 - JULY 2019

Led the Canadian statuary audits for 2 Fortune 500 clients; Panasonic Canada and Emerson Electric Co., Quarterly reviews for a TSX 60 client; CCL Industries Inc., and 3 National Pension Audit for CPG companies. These audits were following US GAAP (ASC 606, 450, 350 & 330) and Canadian GAAP (ASPE) conversion.

Performed US SOX compliance audits for Emerson Electric Co’s Canadian and US scoped-in entities for fiscal audits.

Acted as a project manager for CCL Industries’ Global audit spreading across 21 countries, 47 in-scope components (out of 180 total), ensuring all audit teams received required documents to meet all deadlines by the reporting date of public release, while managing 60+ contacts globally.

Exemplified quality leadership skills through coaching, supervising, and motivating other engagement team members.